Description

Income Tax Calculator to Unlock Hassle-Free Income Tax Calculation – 2025 Edition

Are you looking for a reliable and accurate tool to simplify your income tax calculations for 2025? Our “Income Tax Calculator Excel Sheet – 2025 Edition” is designed to make tax planning easy, efficient, and error-free. Whether you’re a salaried individual, self-employed professional, or a business owner, this versatile tax calculator helps you calculate your tax liability under both the 🆕 New Regime and 🏛️ Old Regime, providing you with a clear comparison to choose the best option for your financial situation.

✅ Why Choose Our Income Tax Calculator 2025?

The 2025 Income Tax Calculator Excel Sheet offers comprehensive features that cater to all your tax planning needs, including calculations based on the latest tax laws and slabs. Here’s why our calculator is the perfect solution:

- ✔️ Accurate Income Tax Calculation: Automatically computes your tax liability based on your income, deductions, and exemptions. No more manual errors or complicated calculations.

- ⚖️ New Regime vs Old Regime Comparison: Provides a side-by-side comparison of your tax liability under both the 🆕 new and 🏛️ old tax regimes, enabling informed decisions.

- 💻 Easy-to-Use Interface: User-friendly Excel sheet with simple inputs and automated calculations.

- 💼 Customizable for All Income Types: Supports income from salary, business, profession, capital gains, and other sources.

- 🏡 Deductions and Exemptions Included: Considers all eligible deductions under sections 80C, 80D, 80G, and more.

- 📅 Tax Calculation for FY 2025-26: Updated for the latest tax slabs and rebate provisions as per Income Tax Act 1961.

- 🟢 Effortless Comparison: Compare tax liabilities easily and understand the benefits of each regime.

- 📊 Advanced Excel Formulas: Leverages Excel’s powerful features for automated calculations, reducing complexity.

- 🔧 Flexible and Customizable: Tailor calculations based on your financial situation for precise tax planning.

- 🖨️ Printable Reports: Generate tax summaries and reports for record-keeping or submission.

- 💡 Tax Planning for 2025: Optimize your tax savings with strategic deductions and exemptions.

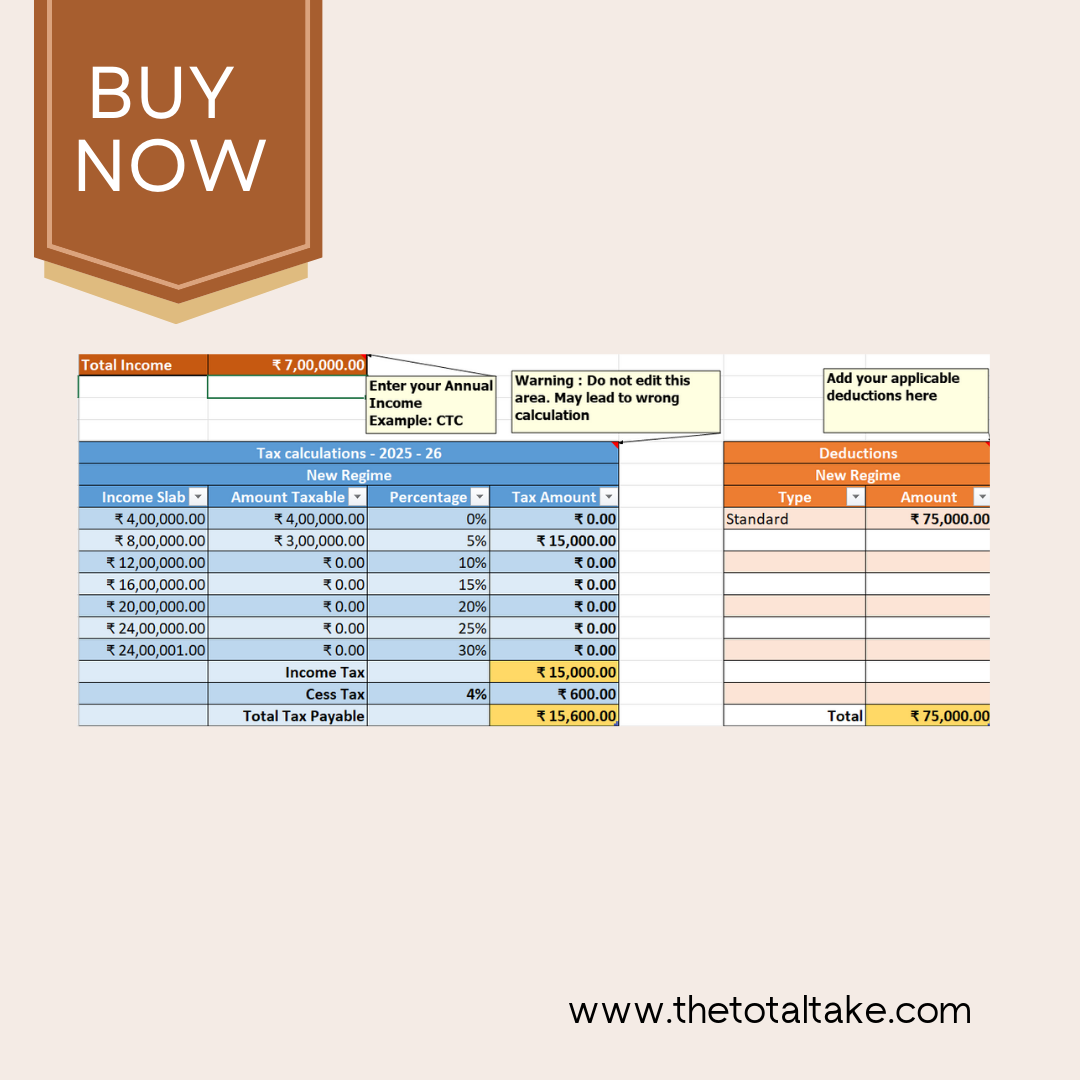

🟢 How the Income Tax Calculator 2025 Excel Sheet Works

Using the Income Tax Calculator Excel Sheet – 2025 Edition is simple and straightforward:

- 📝 Enter Your Income Details: Input your salary, business income, rental income, capital gains, and other sources of income.

- 🆕 Select Tax Regime: Choose between the 🆕 New Regime and 🏛️ Old Regime based on your preference.

- 🏷️ Add Deductions and Exemptions: Include deductions under Section 80C, 80D, 80G, HRA, and other eligible exemptions.

- ⚙️ Automatic Calculation: The calculator instantly computes your total tax liability based on the latest income tax slabs.

- 📊 Review and Compare: Analyze your tax liability under both regimes to make an informed decision.

- 🖨️ Generate Reports: Print or save detailed tax reports for reference or submission.

✅ Benefits of Using Our Tax Calculator Excel Sheet

- 🟢 Simplified Income Tax Calculation for 2025 – Eliminate manual errors with automated calculations.

- ⏳ Time-Saving Tool – Instantly calculate your tax liability without complex computations.

- 💡 Strategic Tax Planning – Plan your investments and deductions for maximum savings.

- 🎯 Accurate Results Every Time – Trusted calculations based on updated tax laws.

- 👥 Ideal for All Taxpayers – Suitable for salaried individuals, freelancers, business owners, and investors.

🟢 Maximize Your Tax Savings in 2025 with Our Income Tax Calculator

Tax planning is essential for effective wealth management. Our Income Tax Calculator Excel Sheet empowers you to:

- 🟢 Understand your tax liability under the 🆕 New Regime vs 🏛️ Old Regime for 2025.

- 💵 Claim deductions and exemptions efficiently.

- 💡 Minimize tax outgo with strategic planning.

⚠️ Disclaimer: This calculator is for informational purposes only. It may not consider rebates or exemptions. Consult a tax professional for accurate tax planning.

Reviews

There are no reviews yet.